Contents

Convergence happens when the moving averages move towards themselves. Divergence happens when the moving averages move away from each other. The shorter moving average (12-day) is quicker and responsible for most movements of MACD. The longer moving average (26-day) is less reactive and slower to price changes in the underlying security. Let’s say one is a 50-day moving average, and the other is a 200-day moving average. We’ll then compare these two lines in order to determine how the overall trend is going.

A negative MACD number means that the shorter (12-period) EMA is below the longer (26-period) EMA on the chart. A situation like this is indicative of increasing downside momentum. The bigger the distance between both EMAs, the bigger the negative number of the MACD line is. The hardest part to master with every trading indicator is finding out the best moments to place your buy and sell orders.

The MACD indicator is generally displayed at the bottom of your chart and stays separately from the pure price action. As the name suggests, this tool helps you determine when a price might reverse by placing dots that quickly show you how a price is trending. The MCAD line crossing the signal line from below confirms that a bullish trend will continue on. Use the signal line to tell you whether a trend is speeding up or slowing down, which can help you determine when to enter or exit a trade. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line.

- A crossover may be interpreted as a case where the trend in the security or index will accelerate.

- Even though it is possible to identify levels that are historically overbought or oversold, the MACD does not have any upper or lower limits to bind its movement.

- A “divergence” is when the MACD creates highs or lows that diverge from the highs and lows of the actual price.

- MACD is the difference between a fast and slow exponential moving average.

- The other problem is that divergence does not forecast every reversal.

The EMAs gravitate around the zero line and occasionally cross, diverge, and converge. By monitoring these movements, traders can recognize key trading signals like a divergence, a centerline, or a signal line crossover. This way, the indicator helps you see when a new bullish/bearish trend is about to form. Some traders wait until the cross actually happens to make their trade, while others will try to anticipate crossovers.

Aroon Indicator: Full Trading Guide

A change from positive to negative MACD is interpreted as “bearish”, and from negative to positive as “bullish”. Zero crossovers provide evidence of a change in the direction of a trend but less confirmation of its momentum than a signal line crossover. The MACD indicator is considered to work best in trending markets. This limits its use for traders depending on their trading strategies.

For example, a bullish divergence happens when the MACD forms two rising lows that align with two falling lows on the asset’s price. Conversely, a bearish divergence occurs when the MACD forms two falling highs that line up with two rising highs in the price. Indeed, using a divergence signal as a forecasting tool can be relatively unreliable. A divergence trade is not as error-free as it appears in hindsight since past data will only include successful divergence signals. Therefore, visual inspection of past chart data won’t give any insight into failed divergences since they no longer appear as a divergence.

Trending Topics

MACD is based on EMAs , which means that it can react very quickly to changes of direction in the current price move. Crossovers of MACD lines should be noted, but confirmation should be sought from other technical signals, such as the RSI, or perhaps a few candlestick price charts. Further, because it is a lagging indicator, it argues that confirmation in subsequent price action should develop before taking the signal. It is not uncommon for investors to use the MACD’s histogram the same way that they may use the MACD itself.

At this point, traders should avoid going for a long position. MACD indicators are set up using letter variables (i.e. a,b,c). The ‘a’ and ‘b’ variables represent the periods in time which are used to calculate the MACD series. We research technical analysis patterns so you know exactly what works well for your favorite markets.

With the Moving Average Convergence Divergence, the primary buy sign to look for is when it crosses the signal line. What this indicates is that the momentum is shifting, and the bulls are taking over. There is also another buy signal triggered when the MACD is below the signal line, and both of them are below the zero line. If the MACD line then moves above the signal line, then you have a buy signal. Some traders wait for the MACD line also to surpass the zero line for further confirmation.

The basics of the MACD indicator

The higher the MACD histogram is, the bigger the difference between the two MACD lines is. Trying to better understand those confusing candlestick charts? All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website.

Due to being unbounded and despite being a momentum oscillator, it isn’t used to identify overbought or oversold markets. Lastly, have it in mind that the MACD line is calculated by using the actual difference between two moving averages, meaning that MACD values are dependent on the price of the underlying security. The indicator values of a lower stock may range from -1.5 to 1.5, while the MACD values for a higher one may range from -10 to +10. It is not possible to compare MACD values for a group of securities with different prices.

SpeedTrader receives compensation from some of these third parties for placement of hyperlinks, and/or in connection with customers’ use of the third party’s services. SpeedTrader does not supervise how to calculate tax multiplier the third parties, and does not prepare, verify or endorse the information or services they provide. SpeedTrader is not responsible for the products, services and policies of any third party.

When Should You Trade Using Trading Signals?

The variable c represents the time period of the EMA taken of the MACD series above. That represents the orange line below added to the white, MACD line. Divergence could also refer to a discrepancy between price and the MACD line, which some traders might attribute significance to. Regulated in the UK, EU, https://1investing.in/ US and Canada they offer a huge range of markets, not just forex, and offer tight spreads on a cutting edge platform. Learning TA seems simple because of the way you presented the information to us. Thanking you won’t be sufficient to express my gratitude to you for writing such a wonderful tutorial.

They’re moving because they’re constantly being updated, as the security’s price is constantly changing. The MACD is a versatile indicator and can be used as part of a trader’s tool kit for purposes of confirming trends and potential price reversals. Some traders, on the other hand, will take a trade only when both velocity and acceleration are in sync. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. The Moving Average Convergence Divergence , is a combination of moving averages designed to signal a change in trend.

Get Started with a Stock Broker

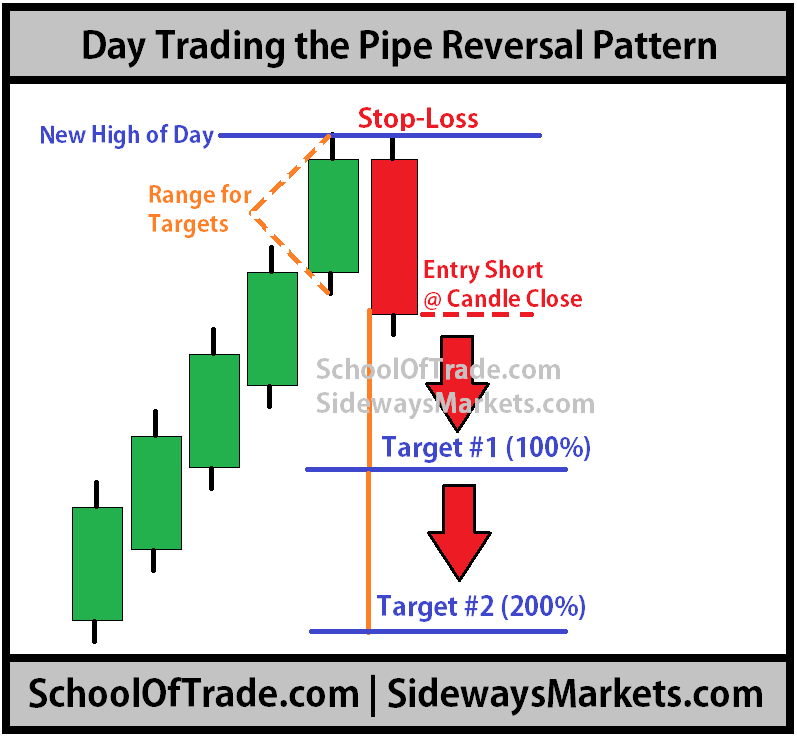

It normally indicates triggers for buy and sell signals, which is a default setting. It also is one of the best trend-following indicators that have been around for a long time. You should position the stop loss at the low of the candle that was the first above the 2 moving averages. I’m not composing this short article to disappoint you but to clarify this concern to you and lead you to an excellent way of believing in order to assist you finding your lucrative trading system. Absolutely you must not rely on those indications if you truly desire to trade and follow a successful system.

The function of the MACD crossover is to give you a signal in the direction of the cross. Since the histogram displays the difference between the two lines, a crossover switches the histogram values from negative to positive and the opposite. The first number refers to the number of time periods used to calculate the faster moving average. The second number refers to the number of time periods used to calculate the slower moving averages. The third number refers to the number of time periods used to compare the two moving averages through the signal line.